Refined Fuel Partners

A Structured Investment Offering Secured Returns. Whether you’re an Institutional Powerhouse or a Retail Investor, Refined Fuel Partners provides secure, de-risked refined fuel opportunities.

Institutional Investors

Retail Investors

The Opportunity at a Glance

Refined Fuel Partners offers a unique investment opportunity for Large Institutional Investors in the dynamic secondary fuel market. This offering is designed for those seeking predictable, high-yield returns, secured through robust financial instruments and a de-risked trading model.

$10M

Minimum Investment

16%

Projected Annual Return

60

Month Fund Life

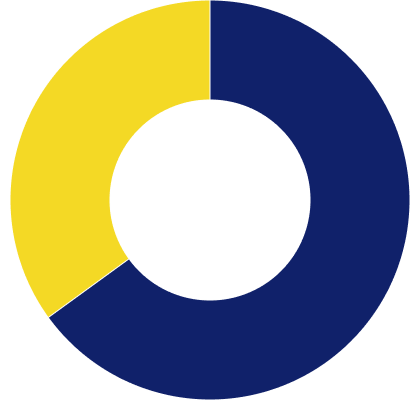

Secondary Fuel Market Overview

The secondary fuel market is a vital segment handling a substantial portion of global refined fuel transactions, operating outside major oil companies. Refined Fuel Partners strategically navigates this market by connecting reliable sellers with pre-qualified buyers.

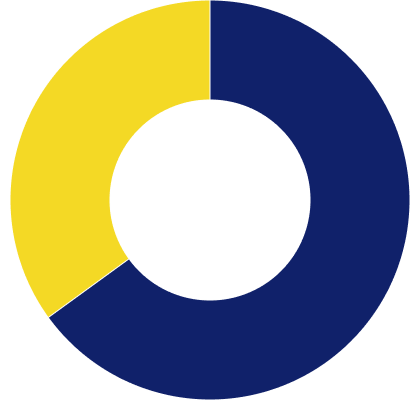

Global Diesel Market Share

Tier I

Tier I Markets, (Majors): 65%

Tier I

Secondary Markets, Niche Players: 35%

Approximately 2.5 billion metric tons of diesel are traded annually, with a significant portion handled by the secondary market.

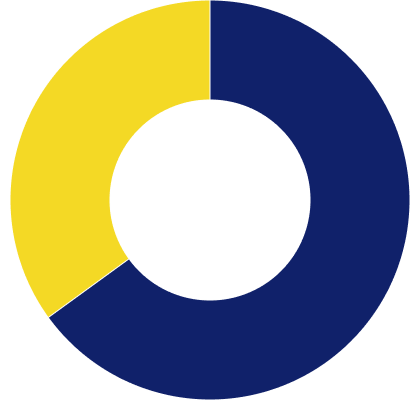

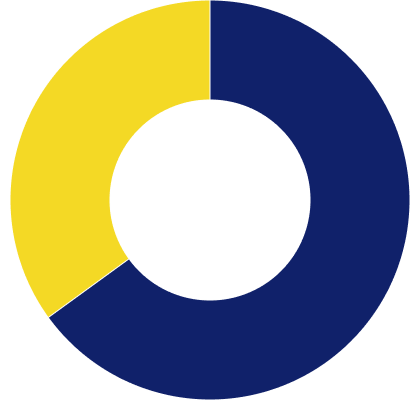

Global Jet A Market Share

Tier I

Tier I Markets, (Majors): 70%

Tier I

Secondary Markets, Niche Players: 30%

Around 2.2 billion barrels of Jet A are traded globally each year, highlighting the scale and opportunity within the secondary sector.

How the Investment Works:

Trading Process

Refined Fuel Partners leverages its extensive network to facilitate structured, predictable fuel

transactions, ensuring consistent returns through a clear, four-step process.

12-Month Fuel Contracts

Structured contracts with fixed monthly takeoff quantities ensure consistent supply and demand for all parties.

Fuel Procurement

Fuel is sourced directly from reliable sellers at a discounted price, building in a profit margin on each transaction.

Resale to Buyers

Procured fuel is sold to pre-qualified, creditworthy buyers at a predetermined price with a fixed margin, ensuring consistent revenue.

Consistent Margins

The fixed margin between purchase and resale prices eliminates variability, providing stability and predictability for investors.

Investment Entity Structure

The investment is structured through a secure Special Purpose Vehicle (SPV) designed to

protect investor interests and ensure transparent management.

Special Purpose Vehicle (SPV)

A Limited Partnership specific to each fuel contract.

Refined Fuel Partners

(The Fund)

General Partner of the SPV

Oversees fund strategy & investor relations.

Investors

Limited Partners of the SPV

Provide capital with limited liability.

Refined Fuel Partners (Operational Company)

Curates and manages all fuel trading deals.

Investment Security & Risk Mitigation

Investor capital is safeguarded through a multi-layered security framework, leveraging industry best practices and robust financial instruments.

Fuel Title Retention

Fuel title stays with Seller/SPV until payment is received; if unpaid, the fuel is promptly resold to a vetted, approved backup buyer.

Backup Buyers

Multiple pre-qualified backup buyers ensure transaction continuity and mitigate default risk by ensuring fuel is always sold.

Transaction Insurance

Underlying fuel transactions are fully insured for the entire 12-month period, guaranteeing principal return in unforeseen events.

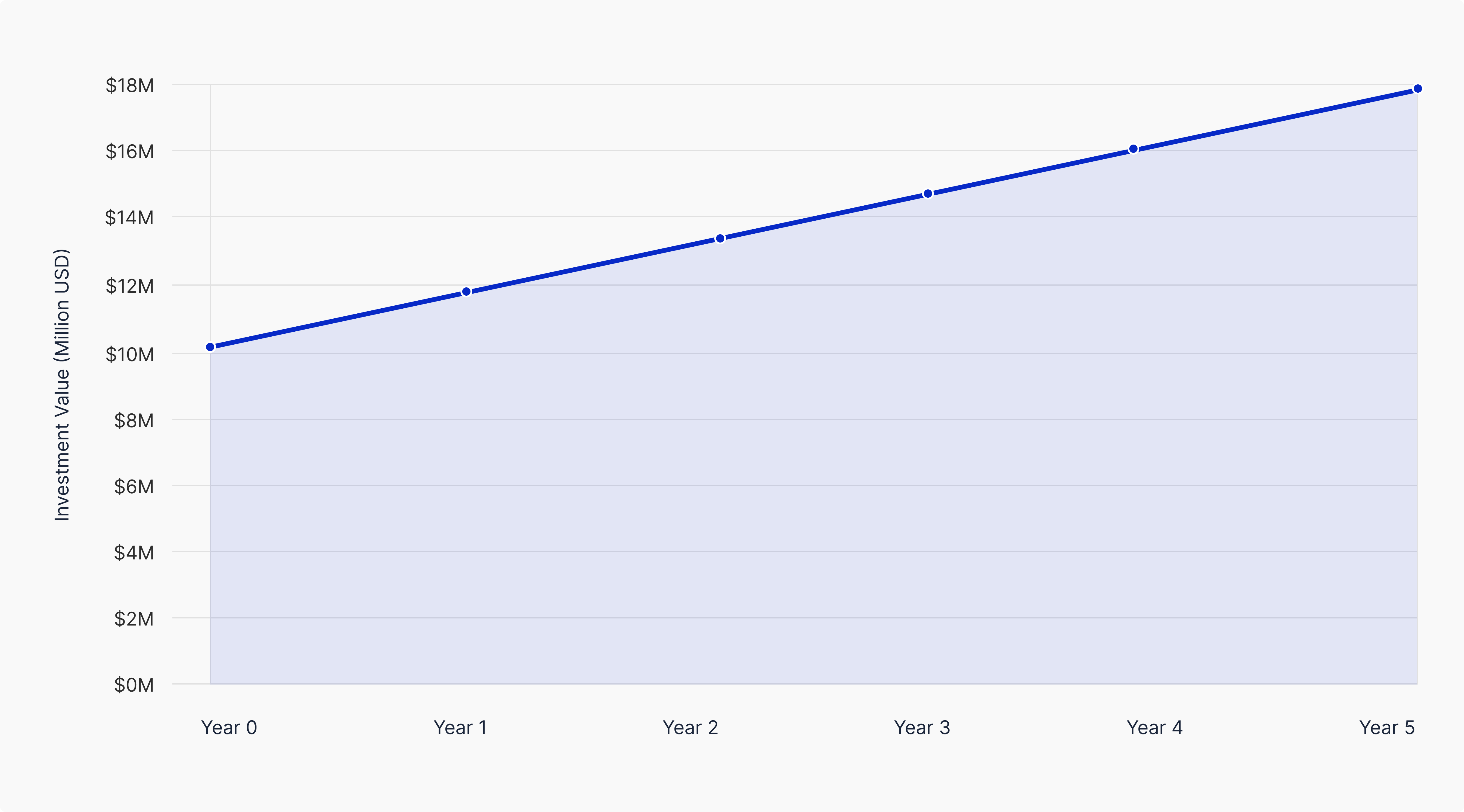

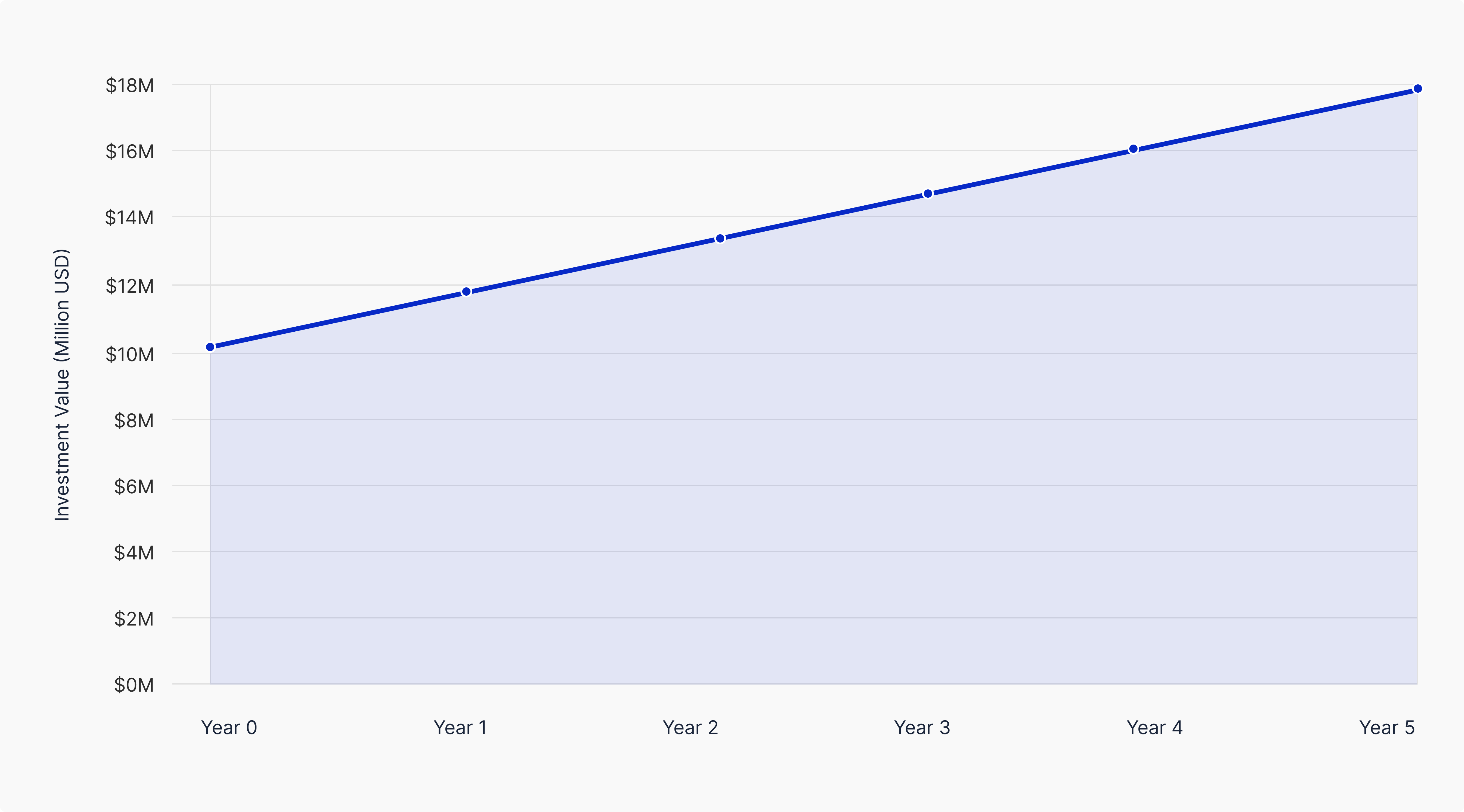

Investment Growth Projection

(60 Months)

Visualize the growth of your investment over the 60-month fund life. Use the slider below

to adjust the initial investment amount and see the projected returns.

Initial Investment

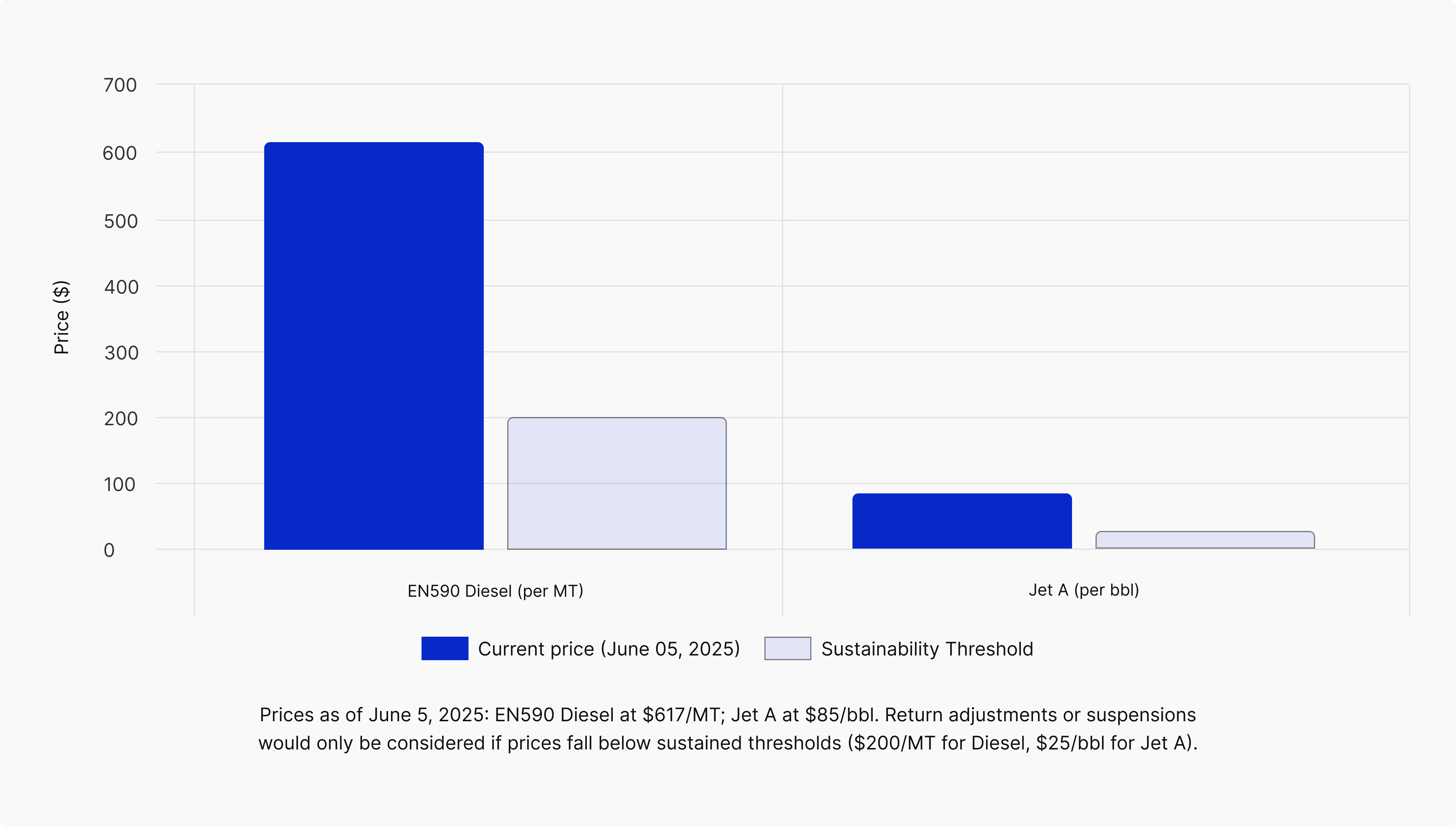

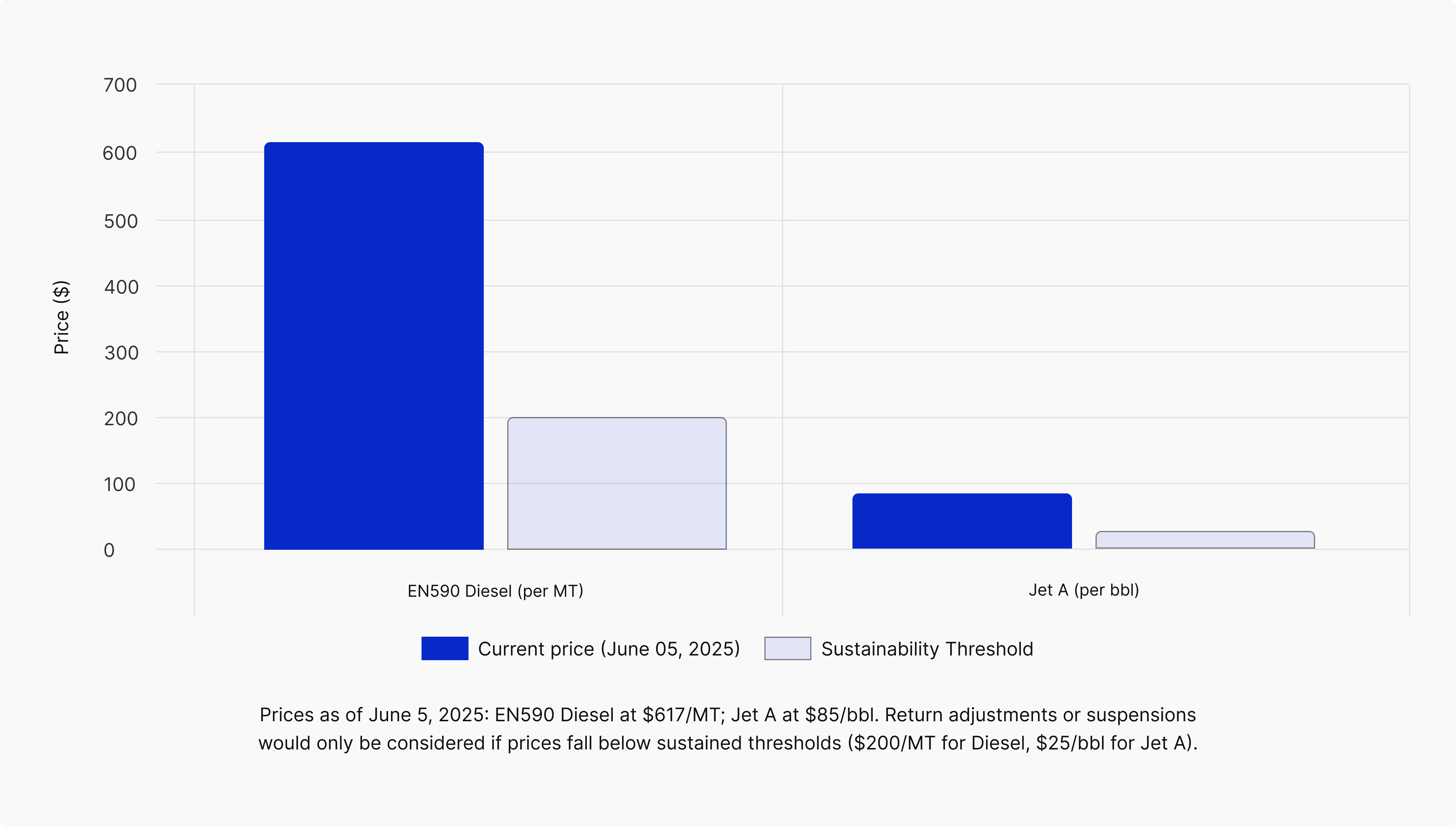

Current Market Prices vs.

Safety Thresholds

The projected 16% annual return is supported by current robust market prices, significantly

above the thresholds where contingency measures would be considered.

Clear Exit Strategy

Investors benefit from a transparent and straightforward exit strategy designed for capital protection and flexible reinvestment opportunities.

SPV Dissolution & Rollover

Investments automatically roll over into new contracts until the 60-month fund end-of-life, ensuring continuous engagement unless unsuitable terms arise.

Full Principal & Interest Return

Investors receive their full principal investment and accrued interest at the end of each contract cycle or at fund termination.

Reinvestment Option

Investors have the option to reinvest their returns and principal into subsequent contracts, maximizing long-term growth potential.

Refined Fuel Partners LLC | CONFIDENTIAL OFFERING MEMORANDUM

Minimum Investment: $50,000 | Date: May __, 2025

The Opportunity at a Glance

Refined Fuel Partners offers a unique investment opportunity for Large Institutional Investors in the dynamic secondary fuel market. This offering is designed for those seeking predictable, high-yield returns, secured through robust financial instruments and a de-risked trading model.

$10M

Minimum Investment

16%

Projected Annual Return

60

Month Fund Life

Secondary Fuel Market Overview

The secondary fuel market is a vital segment handling a substantial portion of global refined fuel transactions, operating outside major oil companies. Refined Fuel Partners strategically navigates this market by connecting reliable sellers with pre-qualified buyers.

Global Diesel Market Share

Tier I

Tier I Markets, (Majors): 65%

Tier I

Secondary Markets, Niche Players: 35%

Approximately 2.5 billion metric tons of diesel are traded annually, with a significant portion handled by the secondary market.

Global Jet A Market Share

Tier I

Tier I Markets, (Majors): 70%

Tier I

Secondary Markets, Niche Players: 30%

Around 2.2 billion barrels of Jet A are traded globally each year, highlighting the scale and opportunity within the secondary sector.

How the Investment Works:

Trading Process

Refined Fuel Partners leverages its extensive network to facilitate structured, predictable fuel

transactions, ensuring consistent returns through a clear, four-step process.

12-Month Fuel Contracts

Structured contracts with fixed monthly takeoff quantities ensure consistent supply and demand for all parties.

Fuel Procurement

Fuel is sourced directly from reliable sellers at a discounted price, building in a profit margin on each transaction.

Resale to Buyers

Procured fuel is sold to pre-qualified, creditworthy buyers at a predetermined price with a fixed margin, ensuring consistent revenue.

Consistent Margins

The fixed margin between purchase and resale prices eliminates variability, providing stability and predictability for investors.

Investing Through Inspira: Our Trusted Partner

Inspira Financial is our dedicated partner, providing a secure and intuitive platform for our clients to manage their investments. Through Inspira, we ensure a seamless and transparent investment experience from commitment to returns.

Digital Platform Access

Access your Refined Fuel Partners investment dashboard securely via Inspira's online portal.

Transparent Reporting

Monitor your projected returns and fund performance with clear, real-time updates directly on the Inspira platform.

Secure Investment Flow

Your funds are securely processed and managed within Inspira's robust framework, ensuring compliance and protection.

To invest, clients will initiate their commitment directly through the Inspira Financial platform. The process involves registering, completing necessary investor verification (KYC/AML), and then allocating funds to the Refined Fuel Partners offering within their secure account. All documentation and transaction confirmations will be accessible through Inspira, ensuring a fully integrated and user-friendly experience.

Investment Entity Structure

The investment is structured through a secure Special Purpose Vehicle (SPV) designed to

protect investor interests and ensure transparent management.

Special Purpose Vehicle (SPV)

A Limited Partnership specific to each fuel contract.

Refined Fuel Partners

(The Fund)

General Partner of the SPV

Oversees fund strategy & investor relations.

Investors

Limited Partners of the SPV

Provide capital with limited liability.

Refined Fuel Partners (Operational Company)

Curates and manages all fuel trading deals.

Investment Security & Risk Mitigation

Investor capital is safeguarded through a multi-layered security framework, leveraging industry best practices and robust financial instruments.

Fuel Title Retention

Fuel title stays with Seller/SPV until payment is received; if unpaid, the fuel is promptly resold to a vetted, approved backup buyer.

Backup Buyers

Multiple pre-qualified backup buyers ensure transaction continuity and mitigate default risk by ensuring fuel is always sold.

Transaction Insurance

Underlying fuel transactions are fully insured for the entire 12-month period, guaranteeing principal return in unforeseen events.

Investment Growth Projection

(60 Months)

Visualize the growth of your investment over the 60-month fund life. Use the slider below

to adjust the initial investment amount and see the projected returns.

Initial Investment

Current Market Prices vs.

Safety Thresholds

The projected 16% annual return is supported by current robust market prices, significantly

above the thresholds where contingency measures would be considered.

Clear Exit Strategy

Investors benefit from a transparent and straightforward exit strategy designed for capital protection and flexible reinvestment opportunities.

SPV Dissolution & Rollover

Investments automatically roll over into new contracts until the 60-month fund end-of-life, ensuring continuous engagement unless unsuitable terms arise.

Full Principal & Interest Return

Investors receive their full principal investment and accrued interest at the end of each contract cycle or at fund termination.

Reinvestment Option

Investors have the option to reinvest their returns and principal into subsequent contracts, maximizing long-term growth potential.

Refined Fuel Partners LLC | CONFIDENTIAL OFFERING MEMORANDUM

Minimum Investment: $50,000 | Date: May __, 2025

Subscribe

Get exclusive insights, market updates, and fuel trade opportunities — straight to your inbox.

We respect your privacy. We won’t spam you.

Home

About Us

Services

Our Team

Institutional Investors

Retail Investors

Copyright © 2025 Arabia Holdings - All Rights Reserved.